One of the fundamental weaknesses of small-scale enterprises everywhere is being able to secure adequate capital, whether equity or debt, in relatively small amounts. Solving this challenge would become a lifetime goal of the Canadian Federation of Independent Business. It is exciting to say that small firms play a dominant role in job creation and community development, but it doesn't happen unless these enterprises are adequately funded.

My advantage in attacking this challenge was by being a teacher of finance at Ryerson, now a University. I knew this problem would require broad support from the political system and the banking community. The challenge associated with providing financing for small firms is partially a product of our free market system and the easy in and out of the marketplace that we make possible.

In a country like Germany, for example, financing a new bakery is about as risky as financing a franchise in our country, because you cannot start a craft-based business in Germany without having secured a master ticket in baking, which requires five years of apprenticeship.

In our country, banks cover off their risk by asking for personal guarantees, and the owner’s guarantee may not be good enough. In 1972 when I was securing a line of credit of only $20K from my local bank, they required my father to guarantee the loan.

My first battle in the tough business of securing capital for small firms was the fight to preserve the special low corporate tax rate for small corporations. Internally-generated funds are the major source of capital for small firms. We became successful.

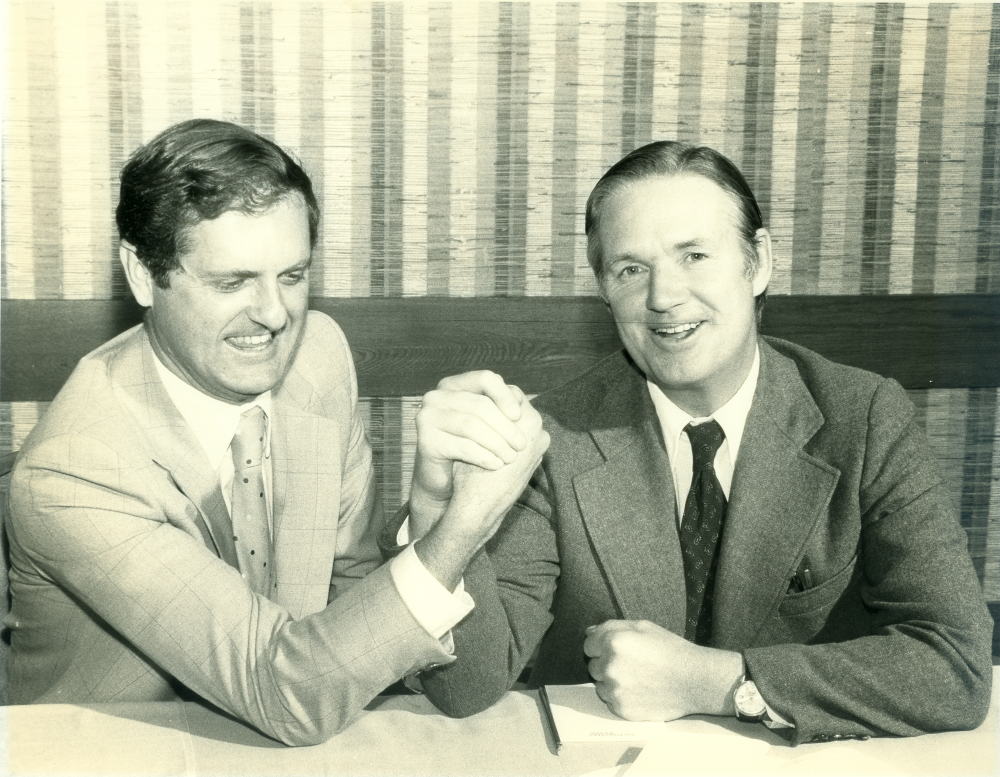

For smaller proprietorships, another victory was making it possible for the owner to pay a salary to his or her spouse, which reduced their combined tax burden. The Department of Finance fought us on that proposal. We partnered with a half dozen other associations to secure that victory. In 1978, while working with the Small Business Minister, Anthony Abbott, we developed an updated credit guarantee system for providing loans to small firms that had no real collateral. The original concept of a credit guarantee system was developed by the Swiss and later copied by about thirty nations. Essentially, under what was called the Small Business Loans Act, a loan made by a bank to a small firm was partially guaranteed by the Federal Government. Today it is called the Canada Small Business Financing Program and loans up to $1 million are possible.

In 1978, while working with the Small Business Minister, Anthony Abbott, we developed an updated credit guarantee system for providing loans to small firms that had no real collateral. The original concept of a credit guarantee system was developed by the Swiss and later copied by about thirty nations. Essentially, under what was called the Small Business Loans Act, a loan made by a bank to a small firm was partially guaranteed by the Federal Government. Today it is called the Canada Small Business Financing Program and loans up to $1 million are possible.

Over the years, I learned that there is no anti-business conspiracy dealing with governments. Government officials just do not understand the dynamics of financing a small business. The solution is small firms who upgrade their skills, banks that train their small business lending officers, and legislation that encourages funding from a wide variety of lenders and investors.