The big rally in Toronto to oppose Edgar Benson’s Tax Reform proposals was repeated in Winnipeg, Calgary, Edmonton and Vancouver. All five rallies raised about $100,000. But the money that was raised with little cost and effort came from my speaking engagements which raised another $50,000 over a period of six months. I had up to ten invitations to speak per day.

The big rally in Toronto to oppose Edgar Benson’s Tax Reform proposals was repeated in Winnipeg, Calgary, Edmonton and Vancouver. All five rallies raised about $100,000. But the money that was raised with little cost and effort came from my speaking engagements which raised another $50,000 over a period of six months. I had up to ten invitations to speak per day.

Other surprises helped. Only a few days after the big rally, a gentleman named Jack Barrington arrived at our office and said he had a lot of friends in the mining business and said he would like to help. "OK Jack," I said, "You look after mining." And, of course, I completely forgot about him, until about two weeks later a stream of five hundred $25 cheques started arriving from mining companies located in all the remote regions of Canada. I did not know that Jack was the retired past-president of the Mining Association of Canada.

What fun it was. In a secret RCMP report, the government was informed that the Canadian Council for Fair Taxation was a front for the mining industry.

But once we got rolling, we directed our opposition on many levels outside of traditional media activity and sent commentary to all the weekly papers in Canada, and voice clips to all the radio stations. I was invited to special white paper events in Montreal, St. John, New Brunswick, Belleville, Ontario and numerous other communities across Canada.

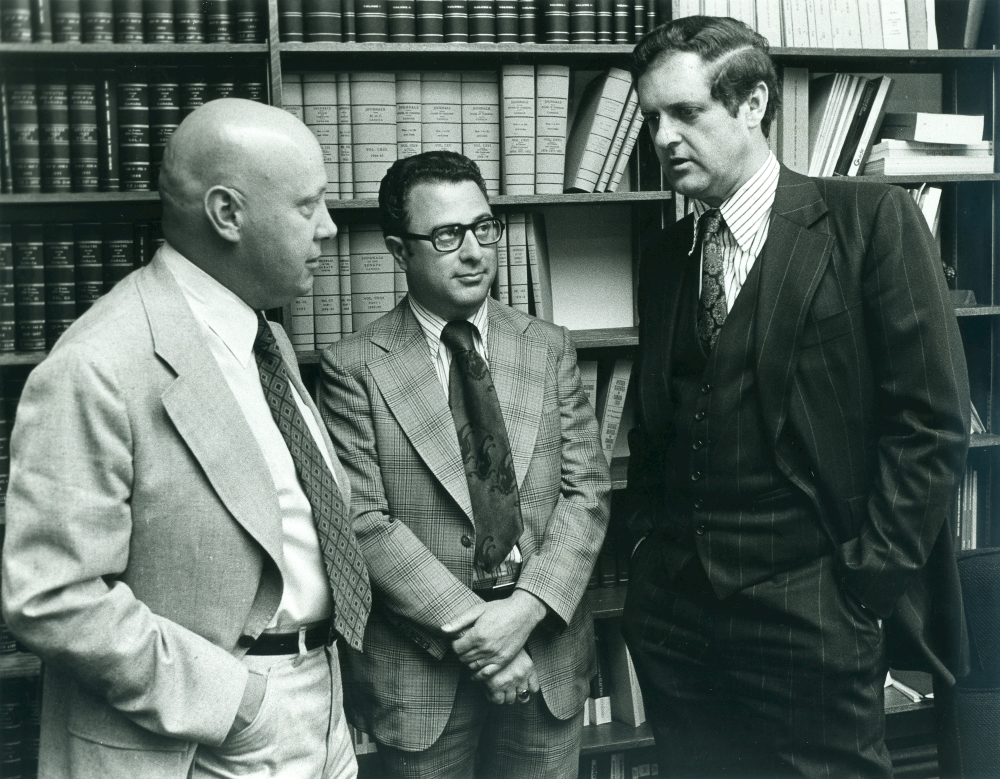

The big challenge was to operate on a professional tax level as well. I appointed Irving L Rosen, CA, who was a tax specialist, to create a tax advisory committee to develop workable options to the White Paper. His committee included two specialists who worked on the Carter Royal Commission on Taxation in the 1960s. Our recommendations were accepted for the most part by both the House and Senate Committees established to hear briefs and make recommendations to the government. Irv Rosen, FCA is shown in a photo with Ron Basford, Minister of Corporate and Consumer Affairs.

We achieved a monster victory with the Minister recommending in his budget of 1971, the restoration of the low tax rate for small business corporations, and the elimination of Estate taxes. All the proposed changes had to wait until a new Minister, John Turner, was appointed and new tax legislation introduced in 1972.

The package of technical changes developed by the tax bureaucrats in the Department of Finance quietly disappeared. No one could figure out what they were about anyways.

In every political battle, those that are taken seriously operate on two levels, a political level and a technical level. You need to be political to be taken seriously, and when taken seriously you need to know what you are talking about.