Some history is significant here. Early in Prime Minister Mulroney's term of office, he created the Neilson Task Force, headed by the Deputy Prime Minister Eric Neilson from Whitehorse. And a CFIB Board member, Ron Farano, was a member of that task force. Ron informed us that their examination of over 1,000 spending programs did not have the support of the Prime Minister.

Instead, Ron explained that an official in the Department of Finance had the inside track in showing the best way to deal with the deficit, was to implement a European Value-Added Tax or VAT. And Ron, as a tax specialist himself, knew this official personally. I began to see the nightmare ahead.

Our members had examined the options and voted 90% against a Goods and Service Tax (GST) or VAT applied on top of the existing Retail Sales Tax. But they would support a combined federal/provincial VAT which was called the Harmonized Sales Tax (HST) by a vote of 60%.

I had read in detail, two technical reports of the implementation of a VAT in the federal states of Brazil and Germany and in both cases, the federal government had worked with the states to replace their retail sales tax systems with a VAT. We complained that a combined GST and retail sales tax was a compliance nightmare for small firms. We began our campaign against the new sales tax regime appearing before House and Senate Committees, and Catherine Swift and I can be seen presenting the position of our membership to members of the Senate.

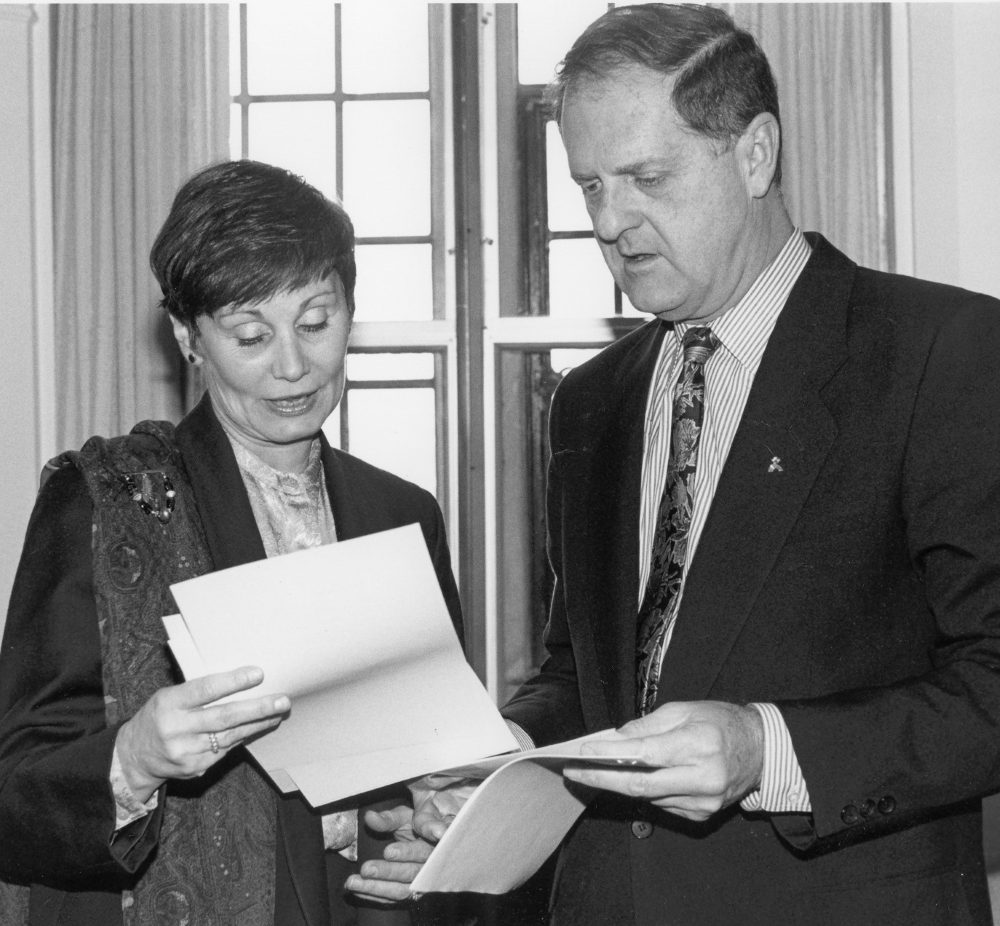

We began our campaign against the new sales tax regime appearing before House and Senate Committees, and Catherine Swift and I can be seen presenting the position of our membership to members of the Senate. Then we met with all the leaders of the opposition parties and in the photo are seen with Audrey McLaughlin of the NDP. No one disagreed with the government’s desire to get rid of the hidden 13.5% Manufacturers’ Sales Tax.

Then we met with all the leaders of the opposition parties and in the photo are seen with Audrey McLaughlin of the NDP. No one disagreed with the government’s desire to get rid of the hidden 13.5% Manufacturers’ Sales Tax. Then we crisscrossed Canada meeting with Premiers to get them on Board in support of the concept of an HST rather than a GST. I began to see some of the problems the Federal government faced with some premiers on side, but unwilling to act if they were facing a provincial election. The photo is with the new BC Premier, Bill Vander Zalm.

Then we crisscrossed Canada meeting with Premiers to get them on Board in support of the concept of an HST rather than a GST. I began to see some of the problems the Federal government faced with some premiers on side, but unwilling to act if they were facing a provincial election. The photo is with the new BC Premier, Bill Vander Zalm.

Our inside intelligence that the Government would use sales tax reform as a tax grab was confirmed when they proposed a rate of nine per cent for the new GST. So, our national campaign calling it a bad tax plus a tax grab took hold, and the Government was forced to drop the rate from 9 to 7 per cent.

The legislation was passed and went into effect January 1991. But our fight was not over. We went to the Supreme Court in 1992 with the Province of Alberta fighting for compensation for collecting the GST. It was not successful, but again, the nation was made aware of the burden imposed on small firms with two sales tax systems.

The public outcry had political consequences. If governments fail to win the battle of public opinion, they pay a considerable price. In the 1993 election, the Progressive Conservatives were reduced to two seats in parliament under a Chretien majority.