Part of the fun working as a teenager for my father was going each day with him to make the bank deposit. We walked over to the CIBC branch at the corner of Yonge and College. There was a real friendship between my father and the branch manager, who worked at that branch for over 20 years. He really knew my father’s business and was a valued advisor.

Now it is 40 years later, and members of CFIB were complaining to us on a continuous basis about problems dealing with their local bank. It is 1982, and we were dealing with high levels of inflation and high interest rates as well as a fear of high levels of business closures. I knew the banking business had changed. No longer did you find branch managers making a career of running a branch operation.

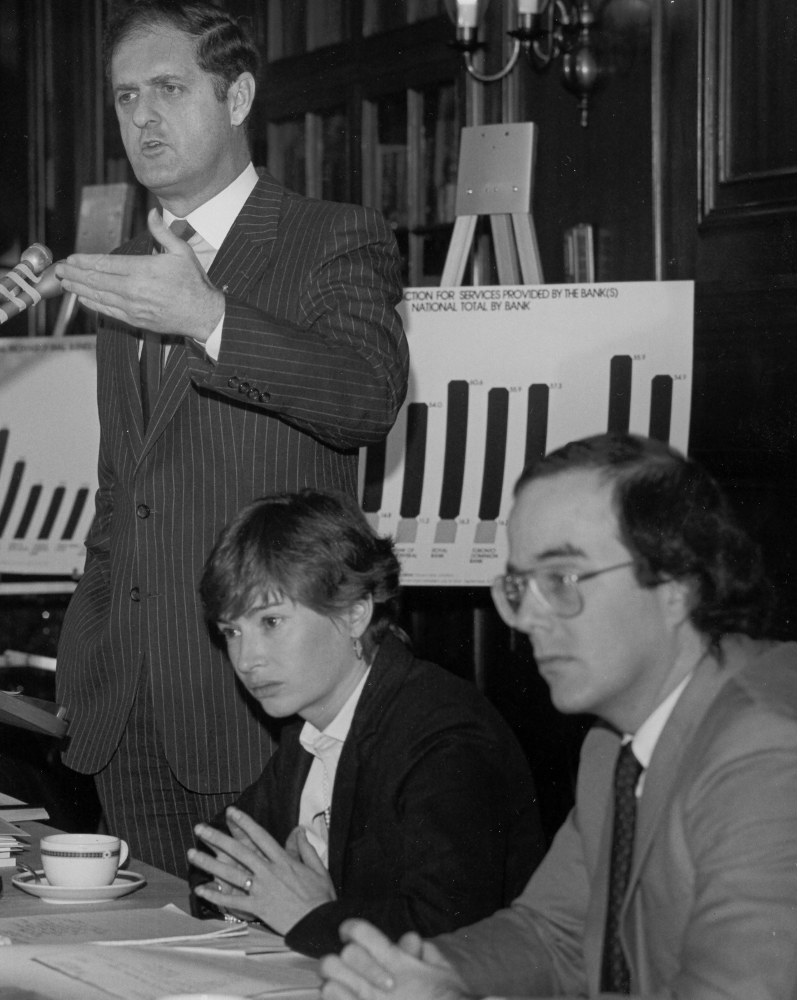

So we decided to do a detailed survey of our member’s banking relationship and find out how they ranked their bank in terms of things like the quality of their banking officer, the amount of collateral required on a loan, service charges and so on. We held a national press conference to announce how our members rated the banks and it was a blockbuster regarding national pick-up. The photo from the press conference shows our results on large posters. Pat Johnson, VP Legislative Affairs and Brien Gray, Director Provincial Affairs accompanied me. The project was spearheaded by Brien.

We held a national press conference to announce how our members rated the banks and it was a blockbuster regarding national pick-up. The photo from the press conference shows our results on large posters. Pat Johnson, VP Legislative Affairs and Brien Gray, Director Provincial Affairs accompanied me. The project was spearheaded by Brien.

One of the most obvious conclusions of our study was that the banking system in Canada compensated for the low level of training of its banking officers by demanding high levels of collateral, as much as 275% times the loan itself.

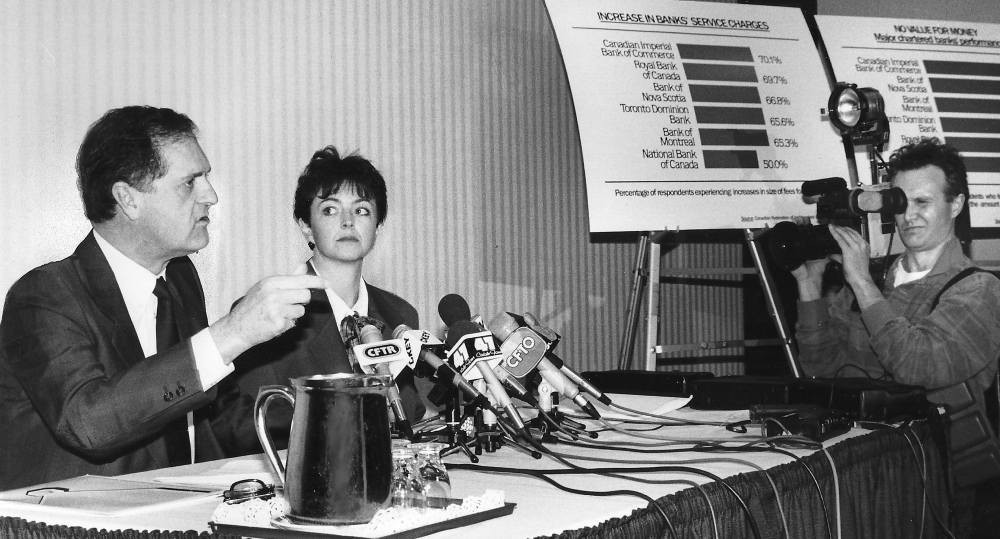

One of the interesting features of this study was confirmation by the Royal Bank who asked the same questions of their clients and got the same answers as CFIB. This was because their VP Small Business, Ken Wilson, was a friend and the former Director-General of the Small Business Secretariat in Ottawa. We gave him our questions so he could verify or reject the results of our survey. We repeated the survey in 1988 and in the photo, we have Catherine Swift as the new VP Policy and Research. Catherine replaced Richard Weitfelt, who had died two years earlier.

We repeated the survey in 1988 and in the photo, we have Catherine Swift as the new VP Policy and Research. Catherine replaced Richard Weitfelt, who had died two years earlier.

By 1988 all the banks had created small business departments and put senior personnel in charge. But the performance of our banks from the perspective of our members had not changed much. Again, the credit unions in both the 1982 and 1988 surveys provided the best banking services to small business. It was not hard to figure out why. The managers of the local credit unions knew their clients, just as my father’s bank manager knew him back in the 1950s.

The banks do not see small business banking as an important profit centre, so unless CFIB keeps the pressure on them, they will not upgrade the quality of their services. The lesson that was most important to us at CFIB was to help improve access to equity financing so small firms would be in a stronger position negotiating loans with their bankers. And our recommendation to members who called in regarding the high levels of collateral demanded by their banker was to “shop around”.